At Put This On, we like saving money as much as, or probably more than, the next guy. Unless the next guy is Mr. Money Mustache, a frugal blogger who retired in his 30s and who promises “financial freedom through badassity.” He’s profiled in the New Yorker this week. I’d speculate that Peter Adeney, the guy behind M. Mustache, would not be a big PTO fan–he publishes his family’s categorized annual spending and the 2014 family total was under $500 on clothing and shoes, well under the 2014 Bureau of Labor Statistics average and a slice of my own personal pie chart. He’d likely tell you that rather than, for example, shopping around for a good value suit for work, you should find a job that pays well and doesn’t require you to wear a suit. And should you want to wear a suit? Simple: Stop wanting to wear a suit when you don’t need to. Stop wanting.

Adeney offers practical advice and an engineer’s certainty in his calculations, and he’s attracted a broad readership reasonably

horrified by consumer debt and the undeniable excess of modern living

in America. In his writing, he has mastered Jim Cramer-esque catchphrases (like “badassity”; consumers are “suckas” who suffer from “short-termitis”), along with the promises of the self help movement, and a drill instructor’s disciplinary tone. He appeals to the part of us that likes to think we could be almost totally self reliant. Truthfully, I wouldn’t want to retire on MMM’s terms. I could never abide by the tenets of his financial religion; beyond the fact that I legitimately enjoy the nonessentials of life, I’m just too damn lazy.

But that doesn’t mean he doesn’t make some salient points for people like me and possibly you, who, when considering clothing purchases, like to substitute research and patience for, you know, having actual money. A few good ones:

- “If you can’t afford to lose it, you can’t afford to buy it yet—otherwise the object owns you rather than vice versa.” I’ve tried to get at this in my posts on “What you can really afford,” and it’s something I think about with the clothes I buy that can be relatively easily lost or ruined. This is why I don’t have a really nice watch and still balk at spending more than $100 on a shirt that I’m likely to roll a meatball down.

- Don’t doubt your ability to DIY. We post a decent amount about DIY work on your clothes–patching, proofing, making your own clothes, etc. A lot of MMM’s savings come in not paying for services most of us choose to pay for, like basic carpentry. The takeaway is that you can often learn the rudiments of something enough to do it adequately, if not professionally, yourself. Check out this intense DIY clothing post on MMM’s forum.

- “Everything is a tiny detail, and even your biggest spending decisions

are really between two shades of a very close bright happy green.” Adeney puts financial decision making in the context of the entire human condition and history. This makes it hard to justify buying…. anything, which is sort of his point. Still, it’s good to keep in mind that any luxury goods are subject to diminishing returns as the price increases, and you have to decide for yourself where you draw the line at worth it. Is it $1000 shoes? $200 shoes? Buying shoes at all if you own a single pair without holes in the soles? - “Whenever you feel like buying something, ask yourself the following questions: Will buying this really improve my overall lifetime happiness? Is there another, more efficient way to meet this same need? Can the same benefit be had if I delay the purchase?” Adeney’s budget advice is another way to discourage impulse buying, which leaves you less money to purchase things that are potentially of more value to you/meet a real need. Again, his purpose is to stop you from buying nearly anything; I’d translate that into budgeting for needs, and leaving some wiggle room for the occasional serendipitous nonessential find.

-Pete

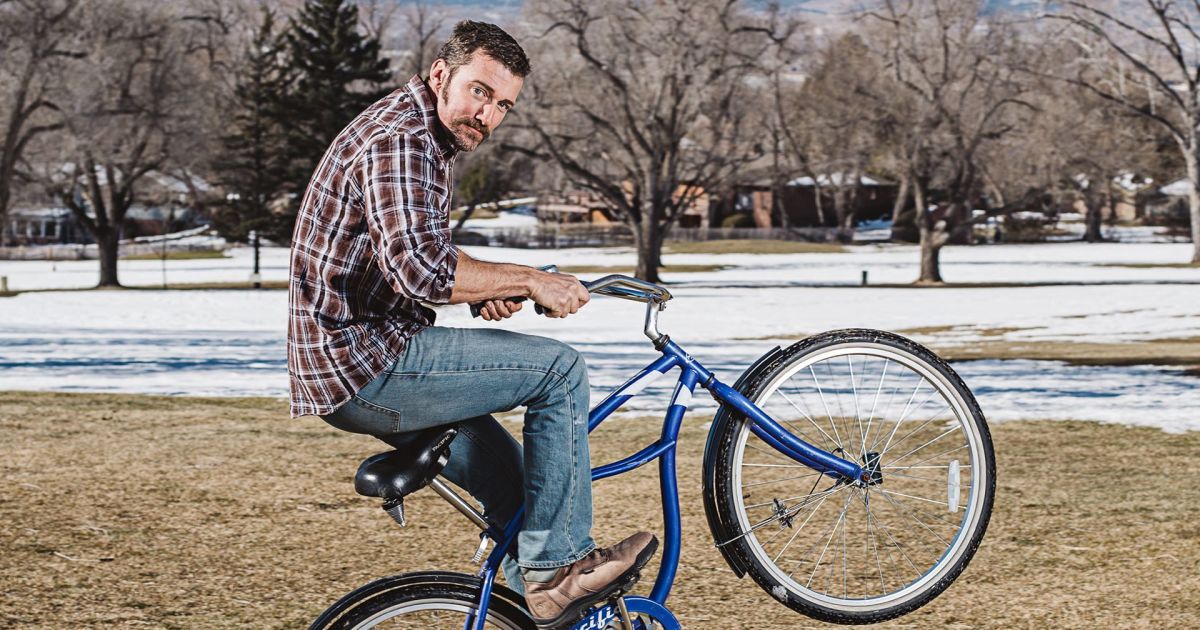

Photo by Michael Friberg for the New Yorker